Every day brings more new stories of the effect of COVID on our society and impact on the economy. Nonprofits across all sectors feel the pinch as well. While the government has passed multiple stimulus bills and debate more, it is easy to forget some of the charitable benefits buried in the CARES Act.

While some may debate the effects of tax implications on donor motivation, the reality is, your donors may be able to score a win-win situation this year.

Nonprofits should remind donors (and potential donors) about the possible benefits of the CARES Act on their giving. And since these tax benefits go through December 31, 2020, there is plenty of time to educate and remind donors even once the pandemic itself has subsided.

Here are the two main benefits that may affect your donors:

New Universal Deduction

Here’s something your donors should know:

Individuals who normally take the standard deduction on their taxes can also deduct up to $300 in gifts for 2020. Additional allowances are made for percentage of charitable gifts to income during this year.

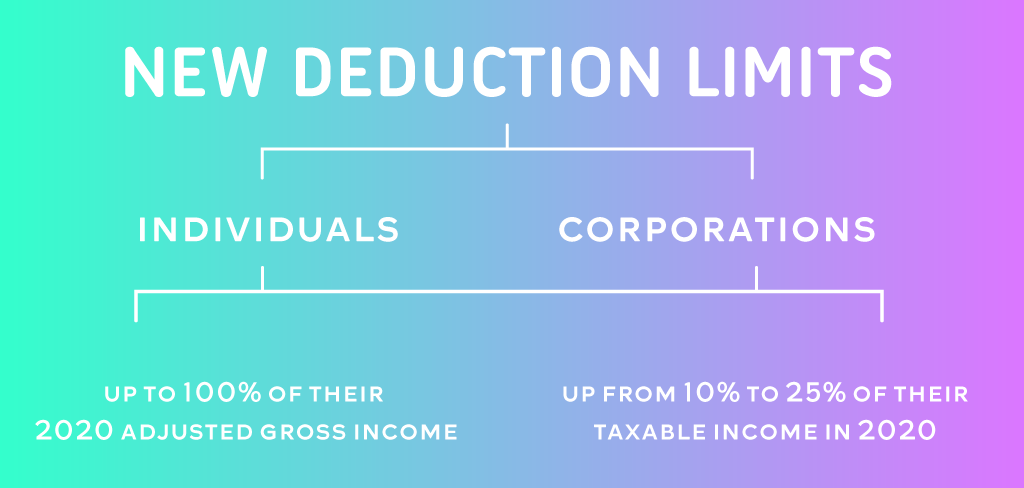

New Deduction Limits

It’s also important to reach out to your major donors and let them know about the new deduction limits provided by the CARES Act.

Individuals and corporations that itemize their giving can deduct much greater amounts of their contributions for the remainder of 2020.

In fact, individuals can elect to deduct donations up to 100 percent of their 2020 adjusted gross income, up from 60 percent. Corporations also saw an increase, from 10 percent to 25 percent of their taxable income in 2020.

However, it is important to note that this new deduction only applies for donations to public charities. So, the old rules still apply for private foundations. The new deductions also do not apply to donor advised funds.

How the CARES Act Can Rejuvenate Your Year

As we mentioned earlier, these new rules are in place for the remainder of 2020 only.

Afterall, the 24/7 news cycle has its hands full these days. And the benefits of the CARES act for individual donors has not been extensively covered.

So, it falls on you to make sure your donors know all of the benefits available to them. As with any item that touches on tax implications, donors should also consult with their tax advisor for their personal situation.

Remember, the CARES Act is a win-win for nonprofits and their supporters. It incentivizes giving during a time when your nonprofit needs it most. And it will help your donors keep more money in their pockets during a crucial time since they can write off larger shares of their contributions than ever before!